How might we help people take control of their financial health?

Each week, hundreds of millions of loyal customers choose Walmart to make the most of their time and money. This loyalty gives Walmart a unique opportunity to expand their brand beyond the walls of their stores and help people save money in many other parts of their lives.

After extensive qualitative and quantitate research, we discovered a number of opportunities unique to Walmart to satisfy some of the more difficult problems in people's financial lives. From this we created the financial ecosystem Life Wallet. At it’s core, Life Wallet is a scalable platform and suite of tools to gives people more ways to save money, earn money, and get visibility into their financial health.

Where to begin. Understanding the user.

Over half a billion people shop at Walmart every month, so focusing on such a large and diverse population set can be challenging. We found that 40% of Walmart’s customers fit into two categories: Financially stretched busy family and time starved busy family. We decided to focus on these two groups by interviewing 50 Walmart customers in these segments for 1 hour each.

Understanding the problem

After speaking with 50 customers, the one thing became very clear was that the biggest challenges were related to managing their finances and making it through unexpected life events. Just about all our customers felt unprepared to deal with an adverse event and most had less than one week of pay in their savings account.

What we heard.

During the hurricane, we ran out of money staying at the hotel for a week. We had to pawn our wedding rings to get groceries because we didn’t have any money left.

-Amanda B.

It’s challenging when I have to buy bigger items. It would be great if I could pay them off with installments.

-Trisha R

Budgeting has become a priority now that I have a son to be. My wife and I budget together, we are getting better as a couple.

-Quinton F.

User feedback as our guide

To quantify how desirable the concepts were to our users, we tested the top 12 concepts with 1,200 customers in our segments using the concept sketches and descriptions. We used Walmart’s existing Walmart Pay and

Savings Catcher as a benchmark. These apps make up a significant part of Walmart’s online revenue and engagement so it is an ambitious benchmark. This allowed us to prioritize and define the product vision at both a concept level and feature level.

Design principle 1: Family first

We heard from our users that they put family first so unlike most financial apps that put money first, we put family first so it’s easy to swap money, split bills and reach your goals as a family unit

2. Help me save money

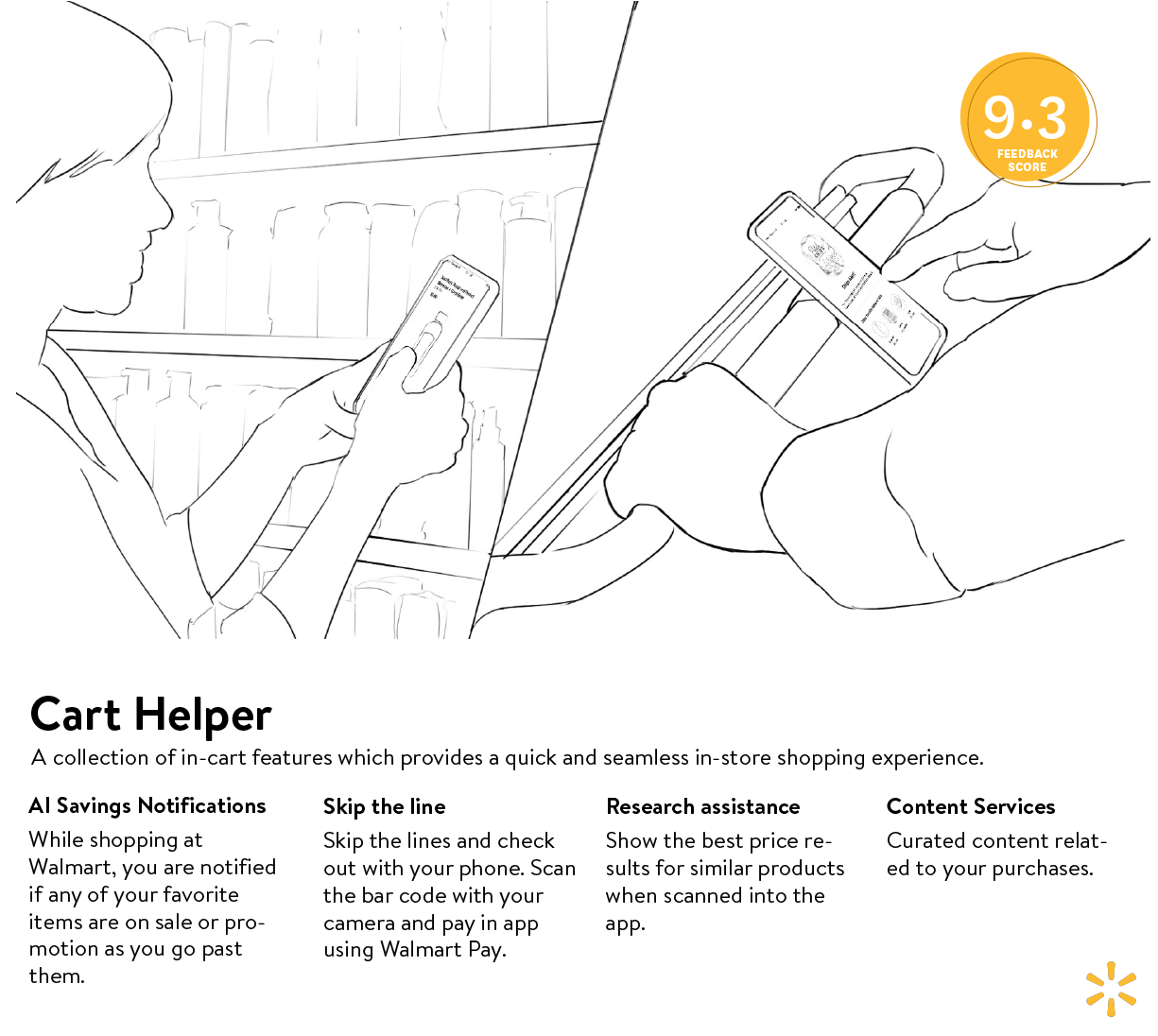

Saving money is important to Walmart customers and they know to trust Walmart’s everyday low prices. They expect Walmart to help them save, even beyond the store walls.

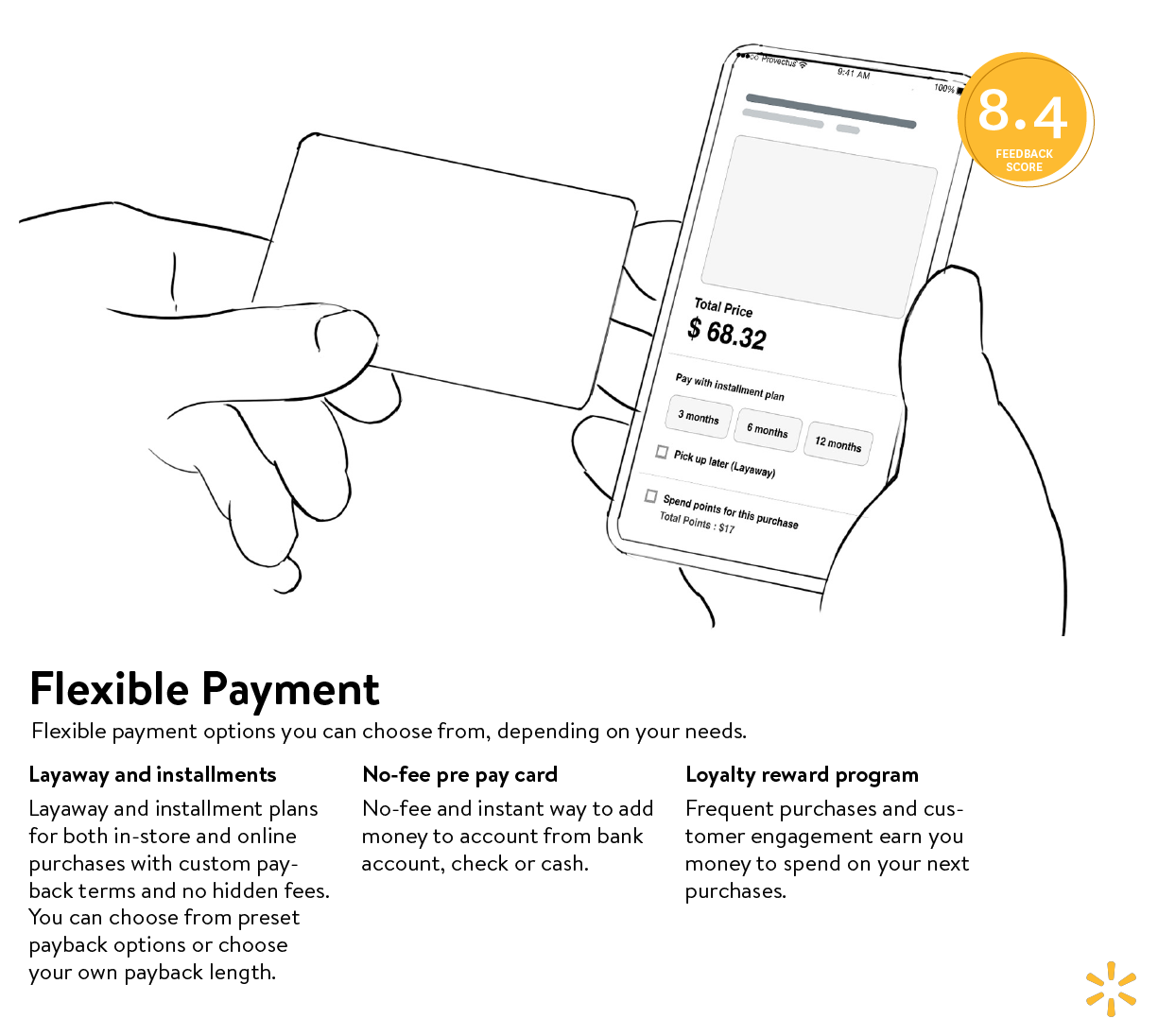

3. Give me financial flexibility

Choosing between buying medication and food is unfortunately a position that a lot people have to face. To help alleviate the financial strain, we designed ultra low interest financial options to help people get the things they need, when they need it the most.

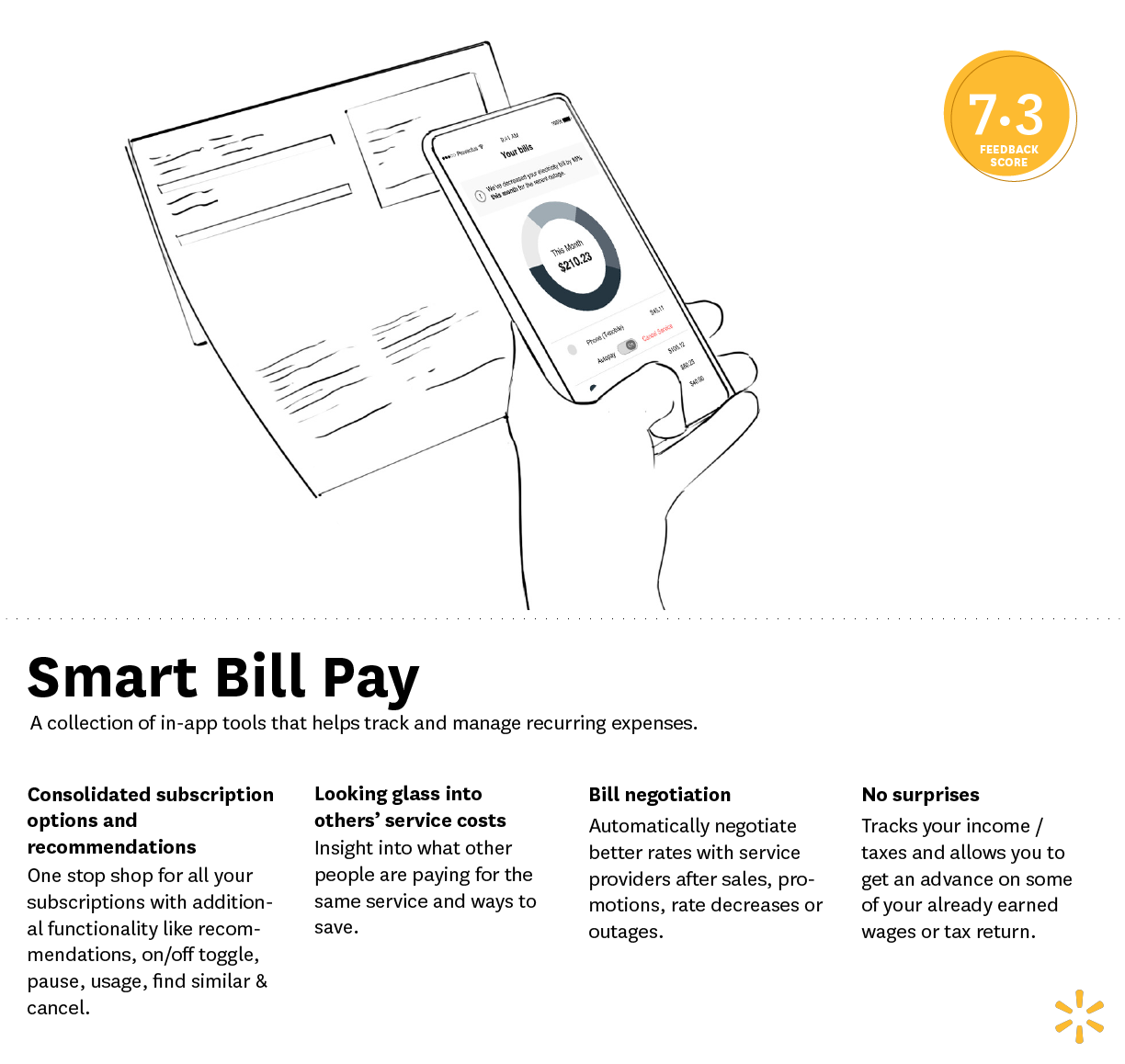

4. Help me plan ahead

Having visibility into finances is really important to Walmart customers. Knowing upcoming expenses encourages longer term financial choices and helps avoid potential problems.

5. To adopt, I need to see the benefit

Adoption is difficult and forcing customers to download an app is out of the question. With this in mind, we built our financial tools into the receipt so everyone has access to it.

Product Demo

To communicate the product objective across the company, we took the concepts that tested well with consumers and met the business objectives of Walmart, and turned them into a product video. This product is estimated to drive $10.6B of new revenue and currently being built through a series of acquisitions and creation of a new business unit within Walmart.

Impact

After 2 years of piloting a platform for employees and Walmart officially announced their upcoming partnership with Ribbit Capital, the investment platform behind Robinhood. The stock jumped 4% on the announcement as it expands the value and importance of the Walmart to its customers.